Cloud is catching on in banking, but many discussions tend to be for or against cloud for the entire IT landscape. Banks can benefit from a more nuanced and fact-based selection between 5 cloud strategies.

The Benefits & Barriers of Cloud Computing in Banking

All industries are implementing cloud solutions at the moment. Banks aim for benefits such as shorter time-to-market, easier ability to plug in fintech innovations and lower risk of technology obsoleteness. However, banks have been somehow later in the game than others, due to a set of significant barriers, e.g., data location & security concerns and "proving" to management that the cloud journey is financially attractive.

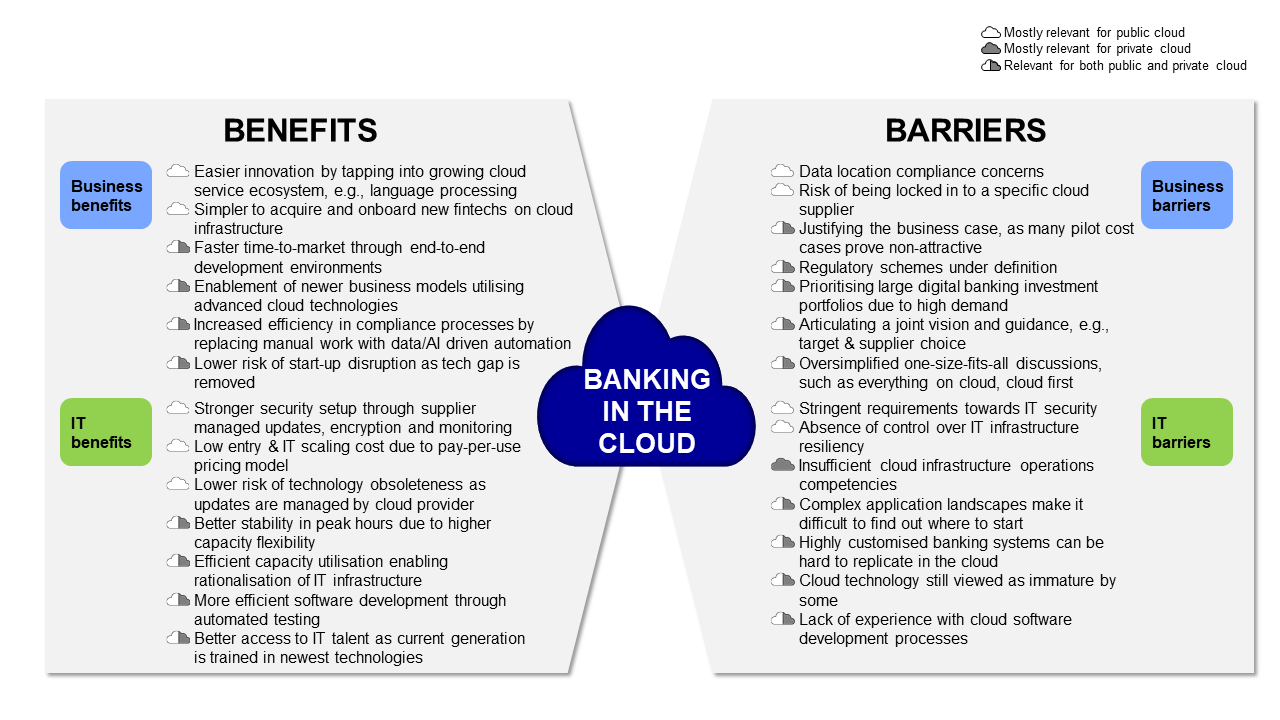

Illustration 1 shows the key benefits and barriers often being brought up in the management discussions, in particular around the public cloud. It is a complicated business/IT decision making effort to weigh the benefits against the risks. As a result many banks tend to get stuck in an "either-or" discussion: Cloud First, Cloud Now or No Cloud strategies. They miss out on the value creation opportunities or start taking too much transformation risk.

Illustration 1: Key benefits and barriers of migrating to the cloud for banks. Analysis by Oleto Associates.

Five Cloud Strategies

A more nuanced approach is needed that can enable banks to accelerate their cloud journey in the areas where it is valuable.

Instead of starting by looking at cloud opportunities at the landscape or portfolio level we believe banks should attack the problem on a business domain or application level first. For example, applications in trade finance, loans, account management, credit risk evaluation, head-office mgmt., etc. Then afterwards, they should aggregate these domain cloud strategies up to meaningful cloud portfolio strategies, including which applications should stay on traditional architectures.

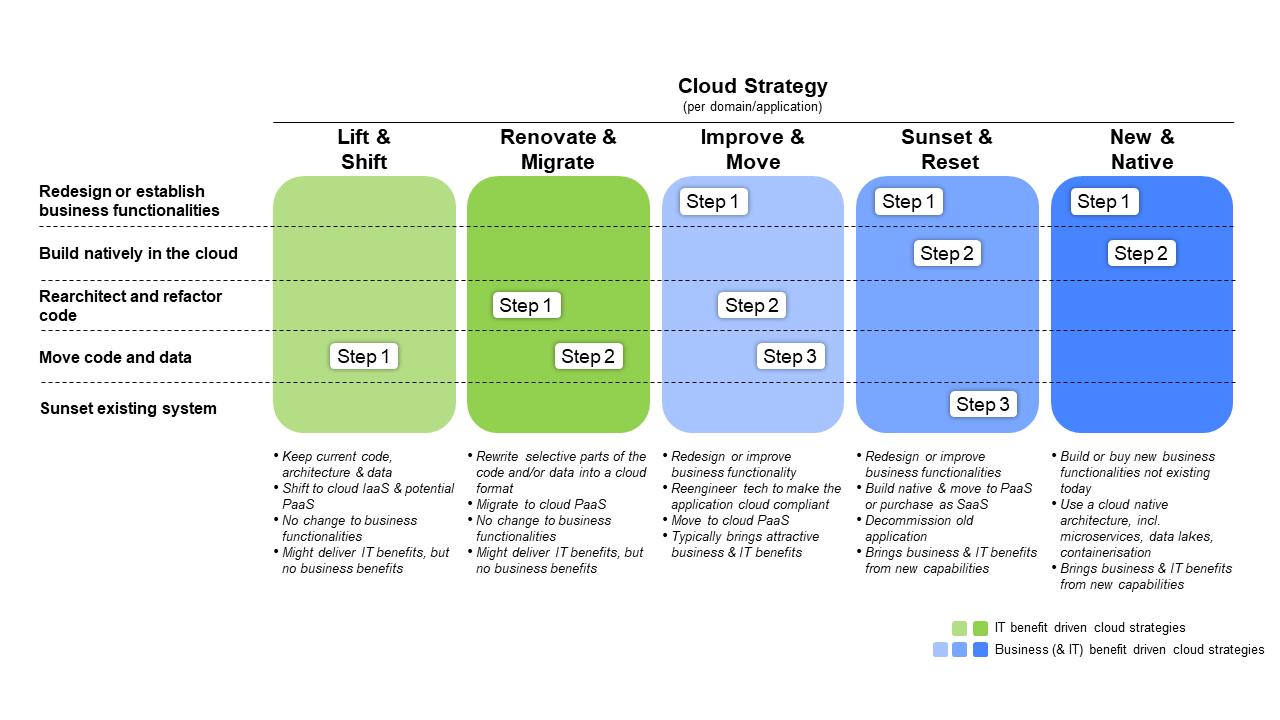

Illustration 2 shows five different cloud migration strategies which banks should choose from.

Illustration 2: Five cloud strategies. Framework and definitions by Oleto Associates (except Lift & Shift)

There are two major strategy families. The "green" strategies cover migrations, where the main focus is on the technical IT side of cloud migration and less attention is given to business value creation. The "blue" strategies focus both on the technical and business side of cloud migration, using the cloud paradigm as a catalytic force to drive business transformation.

We have studied 6 real cases of banks in the midst of their cloud journeys and the strategic choices they seem to have made.

Illustration 3: Six cloud banking cases. Analysis by Oleto Associates.

We observe that cases 1 and 2 have used the "green" IT driven strategies to shift easy workloads or for pilot test before moving towards blue strategies. Most of their future development will then be focused on realizing all of the business benefits in the cloud. Cases 3, 4 and 5 have skipped the "green" strategies and jumped straight to taking advantage of the business benefits of going cloud, including rearchitecting major legacy systems. In case 6 the bank has chosen to essentially build a new bank and gradually sunset its legacy systems.

There are several learnings out of this:

- "Lift & Shift", and "Renovate & Migrate" tend to be rare strategies, that only show positive business cases in few situations. It should therefore only be chosen when strategically important for other reasons, e.g., risk reduction via pilot, consistency/standardization.

- "Improve & Move" is common for large business transformations. Here the cloud migration cost is financed by the overall commercial business case of process and product improvements embedded in a transformation programme.

- "Sunset & Reset" is chosen for outsourcing of non-core business capabilities or quickly tapping into better capabilities in the cloud ecosystem.

- "Native Now" is chosen for business capabilities banks do not have and want to establish rapidly. These capabilities might be offered by, e.g., fintechs.

Cloud strategies are highly situational and must be custom designed on the basis of the unique characteristics of the bank, not as a general "gold rush" to the cloud.

Choosing the Right Cloud Strategy

Bank should device detailed cloud strategies which are built on three pillars: Their current applications landscape, the cloud services offered by the market (and internally) and the business value targeted.

A useful process might be as follows:

- Agree on a business domain structure which divides up the bank into areas that are meaningful from both a business and IT perspective.

- Create transparency on the current application portfolio as a foundation for cloud decisions. Potentially start with prioritized domains. Contact us (at [email protected]) if you want our check list.

- Gather intelligence about the cloud supplier market & specific vendor infrastructure setups, also private cloud capabilities.

- Understand the business agenda in the domains concerned, incl. key transformations of customer approaches, products and processes.

- Summarise the regulatory requirements in the domains.

- For each domain and the applications within it, decide on the viable cloud strategies to consider.

- Develop mini business cases for the viable strategies.

- Aggregate on portfolio level for the entire bank.

- Select pilots and embark on the journey.

About the authors: This article was written by a team of consultants from Oleto Associates, a strategy consulting firm based in Denmark. For more information please visit www.oleto.com

February 2021