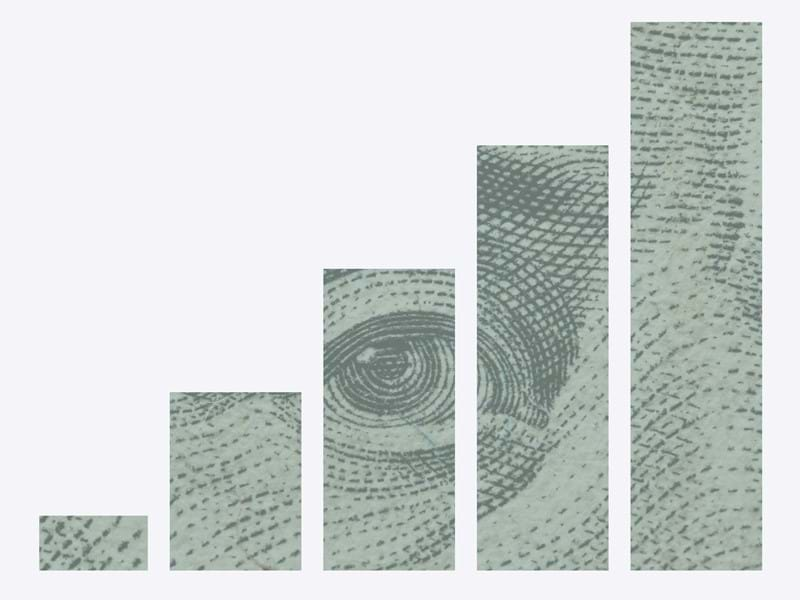

Key industry trends

The private equity industry encompasses different types of investors such as private equity firms, investment, pension and hedge funds, financial institutions and private investors, as well as key stakeholders involved in mergers and acquisitions, incl. legal institutions and target companies.

Current characteristics of the industry:

- Sector has regained strength after the financial crisis and several markets are experiencing all-time high deal volumes

- Valuations have risen to at least pre-crisis levels

- Increased public scrutiny and regulation as a result of the financial crisis

- Wide variety of PE companies catering to various segment needs

Key challenges

We act as a consulting partner to private equity clients to help them manage challenges such as:

- How to identify investment opportunities?

- How to value target companies (commercial and operational due diligence)?

- How to turn around an acquired company?

- What is the exit strategy to ensure maximum return on investment?

- Who are potential buyers for a private equity owned company?

Our experience

Oleto Associates works alongside private equity firms across the entire investment life cycle and takes advantage of our strategic know-how and broad industry expertise to help optimise even the most diversified portfolios.