Telco companies long ago disrupted traditional TV broadcasters but are now hit by three disruptions themselves. Other industries can learn how to profitably hold on to a declining business segment.

Long Ago, Telco Companies Disrupted Traditional TV Broadcasters

In this article we will examine the existing challenges faced by the incumbents within the television content distribution industry, particularly focusing on the players who are responsible for delivering programming to billions of homes globally, including, traditional broadcasters, single channel providers (public/commercial), telecommunication companies, and streaming/over-the-top (OTT) services. The lessons learned from the miscalculations of the incumbents, and the successes gained by the disrupters can provide key insights on how to handle changing consumer habits within other industries.

From the 1930s to the new millennium, traditional broadcasters succeeded in packaging and delivering content developed by artists and producers to the viewing audience. The industry at the time was dominated by broadcasters who primarily developed content and distributed it through radio wave antennas or proprietary coaxial cables, e.g., NBC, ABC, CBS. The accessibility of the internet, and the consolidation of major players within the telecommunications industry quickly changed the landscape of the market near the end of the last millennia.

With the advent of major telecommunication firms within the entertainment and media distribution industries in the last century, the traditional broadcasting industry experienced a wave of disruption. Telco companies purchased some broadcasters and/or created an environment that required their participation in the distribution of content in a way that took substantial supplier power away from traditional broadcasters. In order to broaden their audience base and generate additional advertising revenues, some of the traditional broadcasters positioned themselves in a way to co-exist alongside telco companies, while others expanded their distribution capabilities through acquisitions. As of 2018, TV content distribution accounted for an average of 10-15% of annual revenues for major telecommunication companies.

As more households gained access to the internet, the shifting consumer behavior led to the introduction of unfamiliar competition for the billion-dollar telecommunication companies who relied heavily on owning the distribution infrastructure and customer relationships.

Telco Companies’ TV Business Now Hit by Three Disruptions

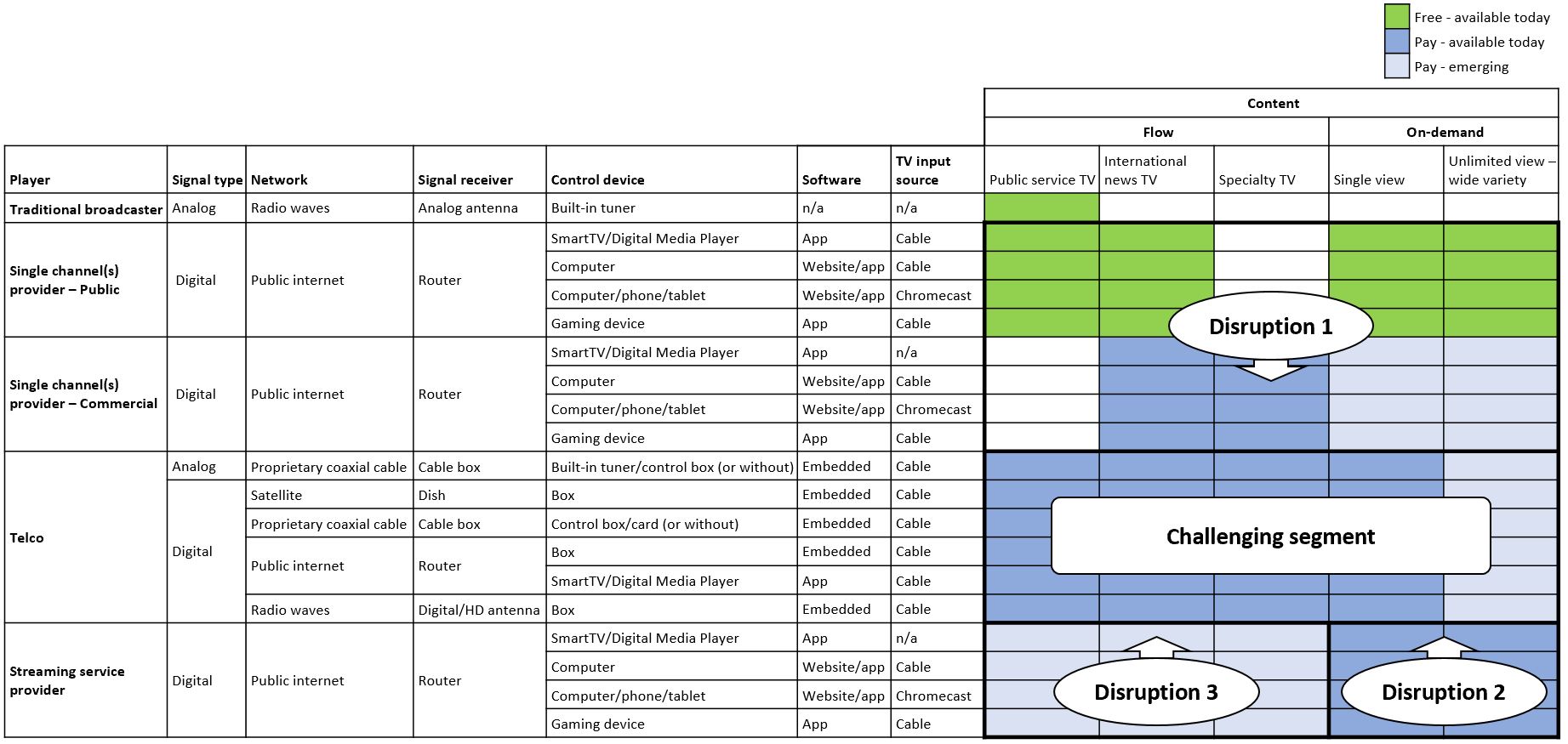

As demonstrated in Exhibit 1, content distributors have over the years evolved their method of delivering content to audiences around the world, e.g., from analog antenna to SmartTV applications. Additionally, the content provided through these distribution channels had for years experienced a relatively clean separation, meaning that telecommunication and broadcasting firms primarily served the needs of customers when it came to content such as public service TV (e.g., TF1), international news TV (e.g., CNN), and specialty TV channels (e.g., ESPN), while on-demand content providers focused on pay per use (e.g., iTunes movies rentals) and subscription based viewing (e.g., Netflix).

Exhibit 1: Content distributed by various players in the industry; Analysis by Oleto Associates; Non-exhaustive

As can be seen in the diagram, the segmentations of the past is no longer as evident, and many on-demand providers are distributing the content that used to be the "traditional playing ground" of the telecommunication and broadcasting firms. Additionally, some broadcasters who in the past primarily used telecommunication firms to distribute their content have now taken it upon themselves to provide their content on-demand or live via the internet, e.g., streaming live content on company websites, uploading content to YouTube.

Disruption 1: Attack on telco companies' core TV offerings – single channel providers offer free and alternative way to watch TV

As the telecommunication companies further tightened their grip on the content distribution industry, broadcasters such as CNN recognized the need to connect directly with their audience and began to utilize online distribution methods. Over the span of several years, most content that could be viewed on TV was also being distributed on the internet, and in the case of single channel public providers, much of the content is free of charge. Telco companies responded inadequately to the threat, likely assuming that consumers preferred the larger screen and would be unwilling to make a dramatic shift away from direct to television viewing.

Disruption 2: Attack on telco companies' TV customers wallet and viewing time – new entrants satisfying the same entertainment needs in new ways

Almost simultaneously, the increased capability of the internet produced the environment for a new industry to flourish, that being the streaming service providers. Initially, the startups within this space were focused on streaming limited TV content, e.g., reruns of popular TV series, streaming of recent popular movies. Telco companies viewed the streaming service providers as supplements to their products and expected that their customers would be unwilling to rely exclusively on streamed content. For many telco companies, streaming service providers were not viewed as direct competition, expecting that customers would continue to remain loyal, as streaming services did not provide local TV and international news content.

Disruption 3: New attack on telco companies' core TV offerings – streaming providers offering configurable TV channel bundles

In the past decade, the streaming service provider industry has experienced exponential growth, and with the increased market size, large players in the industry are today directly competing with telecommunication firms over the same consumer dollar. As the viewership/membership for streaming providers increased, more of the content that was the exclusive domain of telecommunication companies became available through streaming service providers, e.g., local TV channels, specialty TV channels. The consumer began to perceive the streaming service providers' platform as a more user friendly and customisable experience that tailored and personalised the viewing content for their pleasure.

The future of content distribution is likely to experience further disruption, with the opportunity for the incumbents/telecommunication companies to acquire or sufficiently punish streaming services providers unlikely to occur due to the sheer size of companies like Netflix and Amazon.

Other Industries Can Learn How to Profitably Hold On To a Declining Business Segment

The question remains, could the telecommunication firms behave differently to avoid the current realities, or to further benefit from the change in the industry and consumer behavior?

We believe there are 6 key learnings to take away:

- Improve competitive and technology intelligence: Consistently map-out and monitor the playing field within your industry, ensuring that you consider adjacent channels and business segments. This includes emerging technologies which competitors might use to eat into your business segement.

- Leverage customer releationships: Continuously innovate and strive to deliver better products for your customers, while continuing to further develop your relationships with the consumer.

- Bundle or unbundle: Bundle additional products and services that would create a stickier relationship with your customer, so as to make it more difficult for disrupters to take your customers from you. But be prepared to consider unbundling if the customers lack freedom of choice that competitors might be giving them.

- Do not underestimate customers' tech abilities: Constantly work to increase your customer’s loyalty and never underestimate their ability to adapt to the latest technology.

- Fight back early: When and where possible, attack the startups you deem to be candidates for disruption, or acquire strategic startups in order to battle the disrupters on their own playing field.

- Optimise pricing: Experiment with increasing prices until you reach the profit maximisation point.

It is yet to be seen how long telcos will hold on to this declining business, or re-position themselves in the content delivery space.

About the authors: This article was written by a team of consultants from Oleto Associates, a strategy consulting firm based in Denmark. For more information please visit www.oleto.com.

January 2020