A Large and Growing Market

Tableware is something we all care about and use on a daily basis. Tableware comprises plates, cutlery, glasses, linen and mats (not including disposal tableware for this analysis). This market accounted for 30 billion USD in 2018, split roughly 20% - 80% between online and offline distribution channels. The market is expected to grow 4-5% per year rising to 40 billion USD by 2025, mainly driven by Asia and the developed countries.

But why has this rising market been so slow in adopting digital opportunities? To understand this, we need to look at what has happened over the last 25 years.

Channel Cannibalisation Driven by Digital

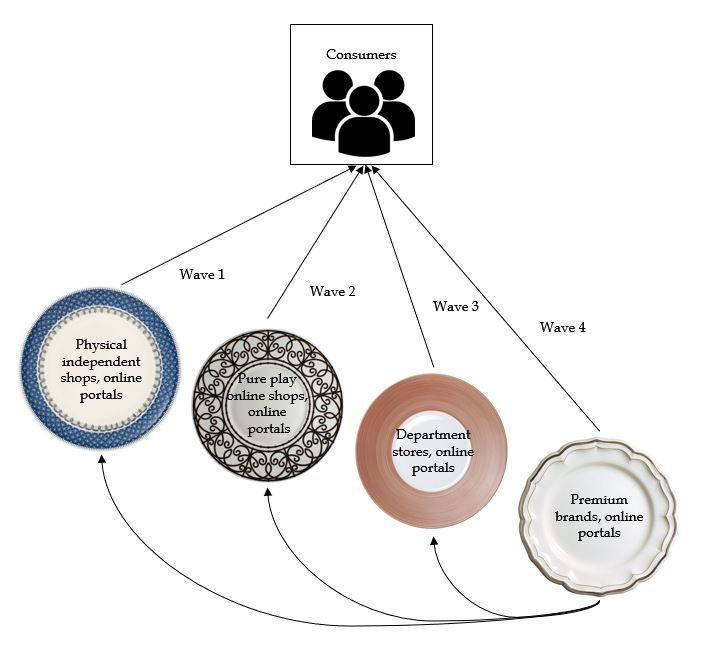

The market has been hit by four digital waves slowly changing the distribution landscape:

- Wave 1: Small physical shops creating large online portals

- Wave 2: Pure play online shopping portals entering the market

- Wave 3: Department stores going online

- Wave 4: Premium brands manufacturers creating direct online sales to consumers

Exhibit 1: Digital channels and disruption waves in the tableware market

Wave 1: Small physical shops creating large online portals

In the middle 90s the big department stores, such as Fortnum's, Harrods (UK), Galeries Lafayette (France), Coin (Italy), Corte Ingles (Spain), Magasin (Denmark) or Karstadt (Germany) did not believe that the newly emerging online distribution channels would change the tableware business, therefore they kept their traditional physical distribution channels and decided to postpone the use of online channels.

However, independent retailers of tableware like All-Clad, Williams-Sonoma, Calphalon, Surlatable, Cutco, CutleryandMore (US), Cristal-Porcelaine or Le Creuset (France), thought differently, and saw a business opportunity.

Coming from physical stores with potential order mail catalogues, they quickly established online catalogues, which then later turn in to full-fledged online stores. Many of these of stores, continued to high-quality advice to the customers both online and offline when they needed help in selecting the products.

Wave 2: Pure play online shopping portals entering the market

From the 2000s and onwards, partly as a result of Amazon and Ebay's success, the tableware market was also inspired by this trend, and many pure play shopping portals appeared, for example, Tischwelt, Dessiq (France), Tableware24, Porzellantreff (Germany), Porzellan24 or SousChef (UK).

These new agents using only the online distribution channel share some similarities, e.g., having no stores, limited stock, usually found by entrepreneurs related to hospitality or services sector. They would typically offer a very wide selection at discounted prices but limited know-how and customer services around these products.

Wave 3: Department stores going online

Around the period 2005-10 department stores around the world finally got their act together and decided to create their own online department stores. Offering amongst others, tableware products.

Special attention should be given to El Corte Ingles, the biggest European department store which is accelerating its digital strategy development. They have recently reached an agreement with the e-commerce Asiatic giant AliBaBa to create a global collaboration in order to impulse their online commerce platforms.

Wave 4: Premium brands manufacturers creating direct online sales to consumers

A couple of years back, many manufacturers of premium tableware brands such as Alessi (Italy), Beauville, Coquet, Haviland, Lalique, La Rochere, Opinel, Yves Delorme (linen only), Raynaud (France), Villeroy & Boch (Germany), Georg Jensen or Royal Copenhagen (Denmark) have created their own online sales platform. These new strategic positions of the premium producers threaten to cut out the middle man (the retailers, such as: online portals, independent shops and department stores).

As a result, for a consumer today there are actually four digital channels to buy tableware from; online portals from tableware stores, independent online shops, online-stores for department stores and online stores from premium brand manufacturers.

Strategic Considerations

Giving this new situation in digital sales channels, what should the four types of players think strategically about right now? Below are some examples of key questions.

Independent physical shops with online portals:

- How serious is the threat of the premium brands offering online shopping?

- How can we win back the market share taken by the recent entry of pure play portals?

- How can we leverage know-how and expertise to strengthen our market position?

Pure play online portals:

- How can we beat other players with a unique online experience?

- How can we differentiate from the department stores and premium brands, e.g., price and delivery speed?

- How serious is the threat from premium brands?

Department stores with online shops:

- How can we leverage out local physical presence to create seamless shopping journeys combining online and offline?

- How can we differentiate from the department stores and premium brands, e.g., price and delivery speed?

Manufacturers of premium brands:

- To which extent will we continue to allow our brand to be sold by online portals, at discounted prices?

- What is our strategy for strengthening online sales by our own online channel?

- What is the right pricing strategy vis-à-vis the other players?

About the authors: This article was written by a team of consultants from Oleto Associates, a strategy consulting firm based in Denmark. For more information please visit www.oleto.com.

June 2019