During the last decade repeatable M&A has emerged as a new structural growth strategy, especially practiced by private equity firms. But how do you ensure that you get every deal right and not only one every 5-10 years?

The Rise of Acquisition Machines

Repeatably acquiring and integrating multiple companies is, for many of today’s companies and private equity firms, a viable approach for rapidly growing their business portfolios.

Acquisition machines, defined as those who are repeatedly acquiring companies over short periods of time in order to expand rapidly, are present in a number of industries. Rather than operating with a one-off M&A deal model, which sees deals executed every 5+ years as firms wait for the optimal opportunity to present itself, many are pursuing multiple deals in a row to build reach and scale quickly. Whether it be a PE backed healthcare group acquiring multiple hospitals, or a retail company incorporating several brands, the emphasis is on speed and momentum to generate maximum value. As a result, the market is becoming increasingly competitive as deals are sought out and firms battle each other for market share.

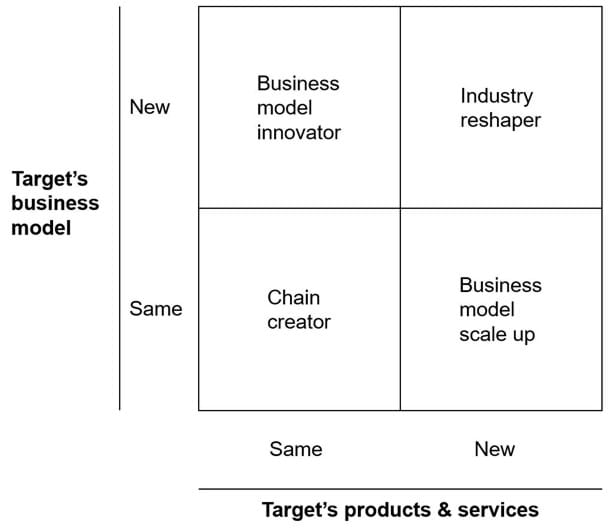

Four repeatable M&A strategies commonly pursued are shown in Exhibit 1:

Exhibit 1: Four strategies for repeatable M&A based on similarity between acquiring firm and target firm; Source: Oleto Associates experience

- Chain creator: In this strategy the repeatable acquirer often adds smaller targets with similar products/services and similar business models. The buyer then selectively harvest synergies across the targets, e.g., branding, procurement, administration, knowledge sharing. One example could be EG's (multi-vertical software house) acquisition of Sonlinc and Lindbak Retail Systems - firms developing software for the utility and retail verticals. EG already provided solutions to these verticals, however those additional acquisitions strengthend their position in the local markets. Additional industry examples could include veterinary care chains , restaurant chains hotel chains.

- Business model scale up: Acquirers following this strategy have a strong business model on which they add their targets. The targets typically have different products or services and the buyer over time builds a powerful multi-product business running on the same business model. One example hereof could be Tryg's, a large non-life insurance company in the Nordics, acquisition of Securator, a leading Danish provider of consumer eletronic insurance Other industry examples could include some professional service firms.

- Business model innovator: Companies following this M&A strategy identify potential targets who could improve the acquiring firms business model and thereby how they create value. The buyer will partially or fully integrate the acquired firms "way of doing business" and through this enhanced approach provide the same service and products to its existing and new customers. Examples hereof could be Amazon's acquisition of Dispatch and INLT. Dispatch developed a platform for offering local parcel delivery services using autonomous vehicles/robots. INLT developed a platform enabling customs clearances "as a service" for customers importing international goods. Both companies were integrated into Amazon marketplace's way of doing business.

- Industry reshaper: In this strategy the buyer acquires companies with very different products and business models and creates a new type of large player in the market. An example hereof could be LMVH's acquisition of Glenmorangie and Ardbeg (Scottish whiskey destilleries). Additional industry examples includes telecommunications and to a certain extend financial services.

Whether the acquisitions are focused on securing new revenue streams, achieving cost synergies, taking ownership of new IP, obtaining critical resources, or a combination of all of these, the trend is towards using repeatable M&A as a rapid driver of expansion.

The Unique Nature of Repeatable M&A Strategies

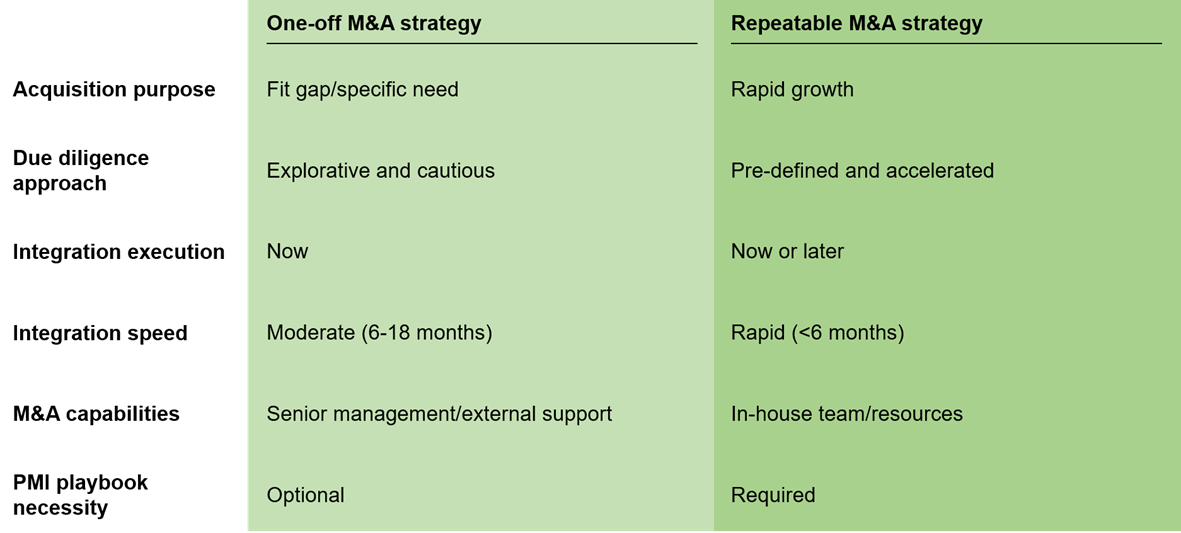

There is a significant difference between the capabilities and mindset that exists within companies that have a one-off M&A strategy and those who aim to create chains, business model scale up's, innovate a business model or reshape an industry through a repeatable M&A strategy. In Exhibit 2, the two strategic approaches to M&A are highlighting across six key areas.

Exhibit 2: How repeatable M&A is different from one-off M&A (examples); Source: Oleto Associates experience

In the following paragraphs, these differences will be elaborated.

Acquisition purpose: The high-level reasoning behind a company’s M&A strategy has a significant impact on how often they acquire and/or merge with another company in a given period of time. Generally, in companies that follows a one-off M&A strategy, the purpose of the transaction is to fulfil a specific business need or fill in a gap in line with their corporate strategy, for example, to benefit from economies of scale, eliminate a competitor or obtain critical IP. On the other hand, in a private equity firm or a large corporation that follows a repeatable M&A strategy, the purpose is often to accelerate growth and obtain a significant position in the market to increase the value of the firm.

Due diligence approach: How a company approaches this integral aspect of the M&A process depends on the institutional knowledge present within the team/company. A firm undertaking a repeatable M&A strategy would rely on its systematic and pre-defined approach which adheres to previous lessons and experience, whereas in a one-off acquisition scenario, the approach to M&A is often more explorative and time consuming due to limited experience (and often done by external support).

Integration execution: If the buyer wishes to integrate the acquired target it is often seen in companies with a one-off M&A strategy that the integration strategy is to integrate the target firm almost immediately after deal closing to secure the value capture. Repeatable M&A firms, on the other hand, follow multiple integration strategies, e.g., acquire multiple firms and integrate instantly in parallel or keep the acquired firms at arm’s length and integrate later and more sequentially.

Integration speed: The time frame in which an acquired company is integrated often also depends on the type of M&A strategy that the acquiring firm is undertaking. Companies who have performed multiple acquisitions and integrations will by nature have more experience and therefore be better able to integrate the acquired firm more rapidly than a company with limited integration experience. Furthermore, to reduce the complexity of having multiple integrations in parallel, the companies following a repeatable M&A strategy are often forced to conduct the integrations faster.

M&A capabilities: It can be costly to develop and maintain proficient M&A capabilities in-house, especially if they are seldom used. Therefore, in companies following a one-off M&A strategy, the acquiring company will predominantly rely on external resources and the experience of the senior management team, whereas for the repeatable M&A approach, there is a good business case for developing a specialised and dedicated function/team in-house to capture the knowledge and accelerate the future acquisitions and integrations.

PMI playbook necessity: The degree to which a company can benefit from a post-merger integration playbook depends on the size, significance and volume of transactions undertaken at a given time. In a one-off strategy approach, there are many benefits to having a PMI playbook to guide the participants through the integration process, especially given that the participants would be less experienced in M&A activity. In a repeatable M&A strategy, the need for a customisable and repeatable playbook is essential to ensuring the successful and timely integration of the acquired company.

Ramping up your repeatable M&A capabilities is pivotal to secure continuous value capture from your M&A strategy. One of the key cornerstones to do so is to develop, maintain and customize your PMI playbook. Often acquisition machines are agreeing multiple deals simultaneously and it is vital that they have well-greased cogs to support their integration process.

Ramping Up the Repeatable M&A Capabilities

To succeed with repeatable M&A your PMI playbook and thereby PMI approach should address at least these 6 topics:

Ensuring systematic knowledge transfer from due diligence process: Due diligence and post-merger integration are by nature sequential and often conducted by two separate teams with little or no overlap in team members. As a result, valuable knowledge obtained in the due diligence process is not always transferred to the integration team. The playbook should address this issue by enabling knowledge sharing between those teams. In repeatable M&A situation the due diligence process overtime becomes a check and activity list speeding up the process.

Defining both the rationale for the individual deal and the group vision: Understanding and communicating what value you expect to realise from the acquisition is critical since this is its actual scope. If you target specific synergies it is important that you both detail what they are, how you intend capture and measure them and develop your integration plan accordingly. Other key questions to consider and communicate upfront are: Do you intend to fully integrate the company, keep at arm’s length or somewhere in between? What are the key integration dilemmas and scenarios, which do you select and how can those choices realise the synergies? Each scenario has implications on the integration work, timeline and required effort. Making and documenting those decisions upfront in the playbook is critical for reducing integration cost and time-consuming rework, e.g., from team members not being aligned on “what they are solving for”.

Establishing a standard integration plan: Having confirmed what value you seek to realise (rationale) and the overall approach for achieving this (ambition), your playbook should then cover in detail which specific activities and deliverables are required to succeed. It is important you divide the integration work into intuitive workstreams and ensure one or more experienced individuals within each workstream details which activities they will execute, when, and what the specific deliverables are.

Putting in a dedicated governance structure: The governance structure for the integration workstreams/teams should be formal, simple, intuitive and reflect the work to be performed. Organizing the integration team in a separate/dedicated structure, different to the acquiring firm’s own structure, can help to signal the importance of the integration work (not business as usual) and anchor responsibilities. The governance structure should be accompanied by selective key role descriptions to ensure project workloads are allocated appropriately.

Consistent progress reporting: Creating transparency from day 1 to the relevant stakeholders during any integration is pivotal. At the same time, we have all experienced situations where the reporting frequency and information requirements have been too comprehensive and not necessarily created value for the recipients. To address this develop simple reporting templates upfront for use by the workstreams members throughout the entire integration venture. As repeatable M&A buyers are likely to have multiple transactions running in parallel it is important that the reporting is consistently cut across common follow-up categories.

Multi-level organisation engagement and support: Executing post-merger integrations typically involves many employees, often individuals whose main focus is daily operations rather than conducting transformation projects. It is therefore important the playbook is developed to help those with no and/or limited hands-on experience. Secure this by including robust and simple guidelines, rules, principles and templates as needed to facilitate as smooth an integration process as possible.

A key common feature for one-off and repeatable M&A strategies - the winners are the ones who are most successful in integrating the acquired targets and capturing synergies which again is dependent on how good a setup the firms have in place.

About the authors: This article was written by a team of consultants from Oleto Associates, a strategy consulting firm based in Denmark. For more information please visit www.oleto.com

August 2020