The possibility of another global economic decline cannot be denied. Can companies proactively plan to soften the impact of a crisis? Cost flexibility can be a viable strategic option.

Several factors could lead to economic decline

Major financial institutions and corporations were forced to file for bankruptcy or were acquired by other firms. Companies in almost all industries were impacted for years to come. After the dust settled, the cost of the financial crisis to the USA economy alone was estimated by the US Treasury Department to be over 19 trillion dollars. Most developed and developing countries around the globe took nearly a decade to recover.

Looking back, we know today that a complex interplay of multiple factors caused the largest financial disaster since the Great Depression. Companies and investors who predicted and/or proactively planned for such a crisis ended up limiting losses or profiting.

A single defining event was not the cause of the recessions of the last decade. Rather, the recessions occurred due to an initial economic event, that were later compounded and reverberated around the globe. Whether there will be another economic decline in the future is not a question of if, but when.

There are several factors that could spiral into the next recession or economic decline, e.g., trade wars, health crisis, natural disasters or political turmoil. Companies cannot fight the possible macro-economic trends but they can think about the levers to soften or sustain the impact of a crisis. One of these are increasing cost flexibility.

Increasing cost flexibility

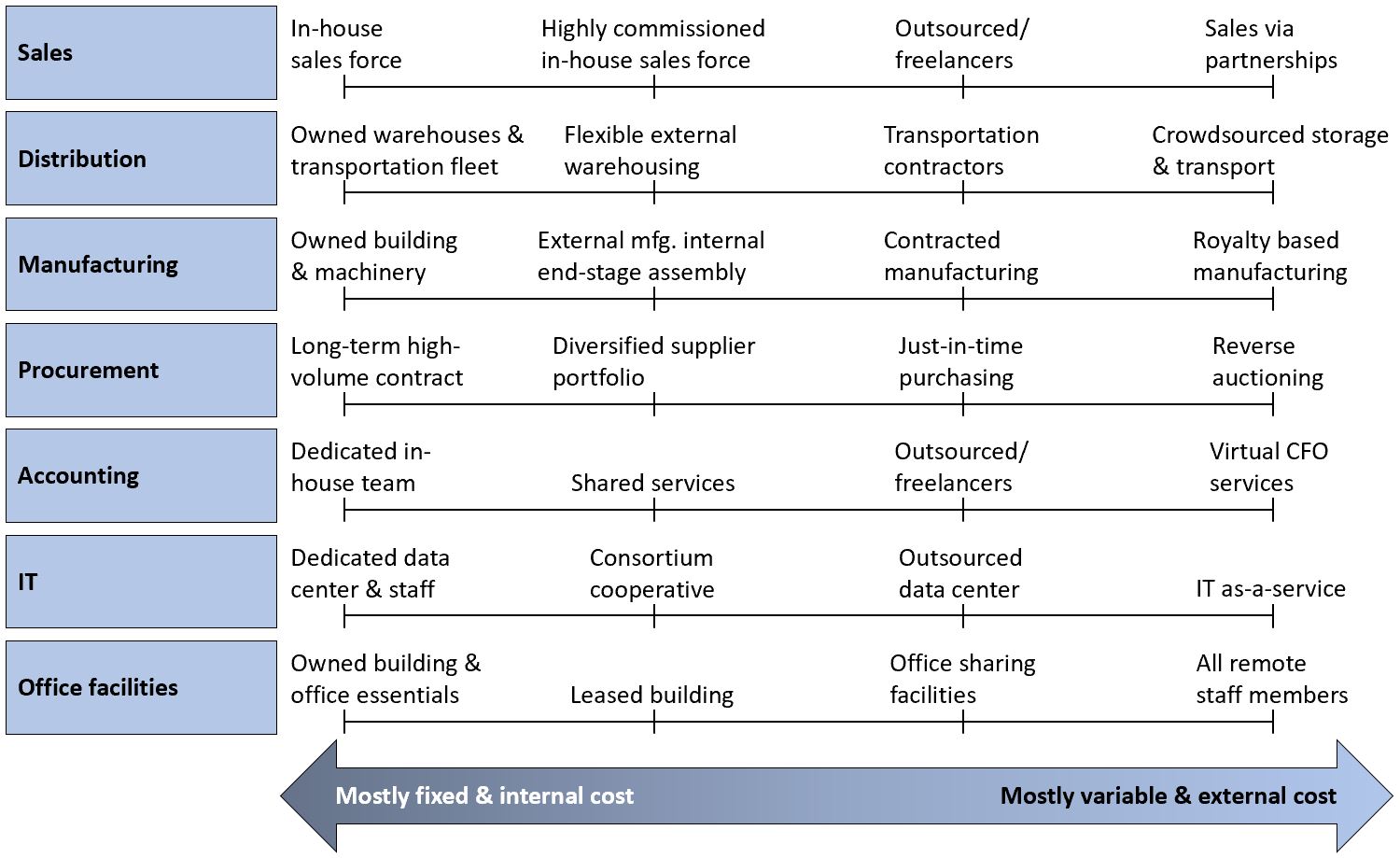

There are several ways that companies can plan to better weather the storm during the next economic decline. In Exhibit 1, some of the key levers are indicated. We posit that a company with low fixed costs and a variable approach to contracts can respond more rapidly to economic downturns, allowing the company to scale down and remain cash positive during the crisis.

Exhibit 1: Pulling the cost flexibility levers to improve response time to potential economic downturns; Oleto Associates

As an organization moves from a more fixed to a more variable cost structure, the exposure to global economic risk for the company can be shifted to external partners (i.e., to suppliers and contractors). Cost flexibility in a company translates to the ability for the firm to scale up and down their production/service delivery within a short period of time.

- Performance based sales: A company with a dedicated in-house sales force may find it difficult to sustain high salaries during a recession without sufficient cash reserves. There are several tools available to make the sales cost more flexible, e.g., commission based sales, outsourced sales, sales via partnerships.

- Scaleable distribution: Owning the warehouse and the transportation fleet for distribution purposes can be a costly investment that ties valuable and needed capital in illiquid assets. There are several approaches to making this cost category more flexible, such as crowdsourcing storage space and your desired transportation needs.

- Externalised manufacturing: Much like distribution centers, manufacturing facilities require companies to park large amounts of capital into machinery and buildings. By shifting to a more variable and external cost such as a royalty based manufacturing, companies can benefit by having additional capital to invest in other core areas of their business.

- On-demand procurement: During an economic downturn, consumer confidence and thus demand for products decrease alongside each other. Companies with flexible procurement contracts can act quickly to decrease their supply cost and stock on hand. This can be achieved through just-in-time purchasing or via reverse auctioning, which provides substantially more cost flexibility to companies.

- Accounting as-a-service: Within the supporting services category, options for companies who want to move towards a more flexible cost structure also exist within the accounting function. Whether it is to outsource the entire department, or move to a virtual CFO service setup, having a reduced salary costs in an economic downturn could mean the difference between success and failure.

- Outsourced IT: The cost associated with operating and maintaining a data center for many companies would be unbearable in an ordinary economic environment, let alone a downturn. With many IT service providers able to sufficiently address the IT needs and requirements of most companies, choosing to outsource IT functions or switch to an IT as-a-service model is less cumbersome then ever before.

- Optimised office facilities: With the high cost of real estate in major business hubs around the world, companies can restructure their workforce to an all remote staff approach, where employees work from home or in shared office space, rather than having to deal with large and expensive to sustain office buildings. This approach has proven successful with several large technology companies, and many startups/scaleups, allowing these companies to handle liquidity challenges in a more adaptive manner.

Of course, there are other tools in the arsenal of a medium to large company to combat an economic crisis, and there are several financial investments available to reduce the risk of adverse price movements of their assets, including currency future contracts, short straddles on equities/indexes, back-to-back hedging, commercial insurances, among others.

When and how to start preparing

Companies should embark on a two-fold approach. Initially, companies should identify areas where they could benefit from cost flexibility in the current economy. Secondly, they should develop a crisis plan for what to do in the event of a sudden economic decline.

No strategy is without its inherent risks. Some companies may choose to move all their business processes from a mainly fixed and internal to a mainly variable and external, while others may wish to simply move one lever, e.g., sales. Prior to undertaking transformations companies should ensure they develop a tailor-made approach and establish the sufficient execution capabilities.

About the authors: This article was written by a team of consultants from Oleto Associates, a strategy consulting firm based in Denmark. For more information please visit www.oleto.com.

February 2020