Stepping outside of the organic growth 'comfort zone' and improving portfolio structure and technology could be key to ensuring long term benefits.

Many Tech Companies Grow Organically and By Acquisitions

Technology industries (software, telco, IT services etc.) are growing rapidly with an estimated global revenue increase at approximately 5% CAGR through to 2024. As is well recognised by these companies, to succeed with this growth and subsequent profit, they are on a continuous mission to provide their customers with an ever-improving range of stronger and more customisable products at a seemingly faster pace.

This constant focus on product portfolio improvement results in many companies following a two-legged product strategy, namely in-house development, and repeatable product acquisitions from the market. As seen in 2020 in the Nordic software market, over 110 deals took place (an 8% rise on the previous year), with deal values totalling over EUR 140 bn.

This rapid product portfolio growth strategy however introduces several long-term profit eroding risks which should be dealt with head on when managing the expanding portfolio.

Cannibalisation and Tech Variance/Obsoletness Put Long Term Profits at Risk

There are two major long-term profit eroding risks to handle in a fast-growing tech product portfolio which are often overlooked, namely: cannibalisation and tech variance & obsoletness.

Cannibalisation: It is common to acquire new products with the intent to enhance the current customer base by getting access to additional customers in both existing and new markets. It is however seldom the case that acquiring multiple products over time will result in a product portfolio with unique/distinct products without any functionality overlap. Acquiring and introducing new products to the company’s current customers can result in existing customers migrating to the new product instead. At best, this will generate a small profit (transfer fee), but in essence the newly acquired product will to a certain extent cannibalise the core product range which in time can have a polarising effect on both the investment prioritisation and customer base, and further reduce product profitability.

Tech variance & obsoleteness: It is rare that acquired tech products are built using the same technology platform as the products in the company acquiring them. Developing, improving, operating, and maintaining multiple products on different technologies is often expensive and makes it very difficult to fully capture synergies, e.g., using common software components, sharing programmer and knowledge resources across products, optimising IT infrastructure setup. In addition, some product, despite generating revenue, use outdated core technologies and obtaining the required capabilities in the market to make the improvements demanded by the customers can be very costly simply due to scarcity.

In essence, while the strategy is perfectly viable it is vital companies make conscious decisions about how to optimise its portfolio to address these challenges. Failure to do so could very well end up in negatively impacting the growth and profit they seek.

As seen in one example, a large European telco provider followed a repeat M&A strategy over several years and ended up with a broad product portfolio containing: telephony subscriptions, network & security services, connectivity products (hardware & software), content delivery network services (CDN), data centre & hosting services and many other products. They did however end up with a large bundle of overlapping products which, to an extent, was based on very different tech. This not only led to enormous confusion about which products to target which customers with, but it also resulted in an expensive cost structure that was rapidly becoming unsustainable.

Tech Companies Should Renew Portfolio Structure and Underlying Technology in a Timely Manner

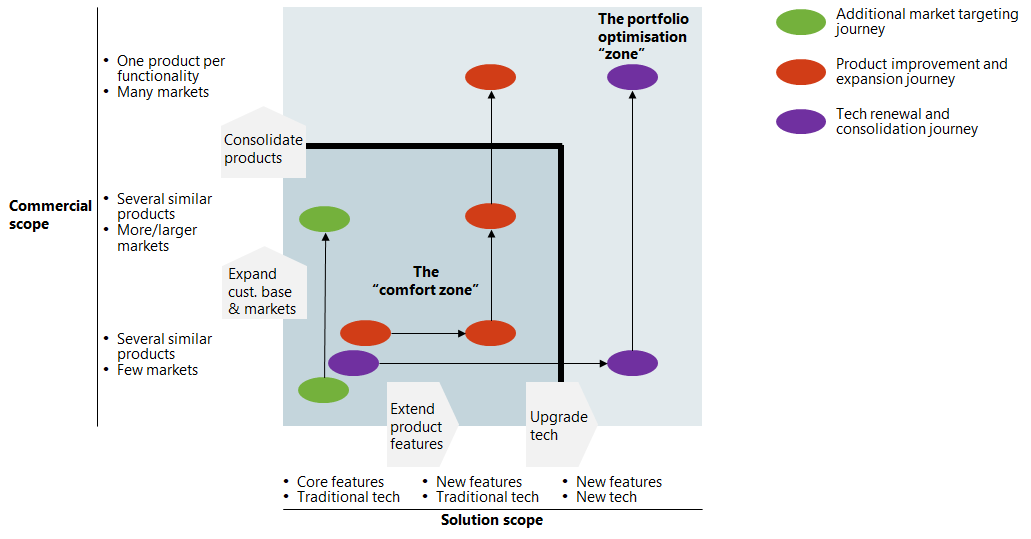

To improve the tech product and product portfolio profitability, four major levers are available to product and portfolio managers, namely: expand customer base & markets, extend product features, consolidate products, and upgrade technology (see illustration 1).

Illustration 1: Succeeding with portfolio optimisation. Source: Oleto Associates.

Expand customer base & markets: By offering existing tech products, as-is, to new customers, segments, and geographical markets, companies can improve their profitability. Slight changes can be made to the product to make it more appealing to the local requirements, but the overall product architecture remains the same. The common changes are mainly at customer user interface level (language variants, layout design modifications etc.) or changes required for the product to be compliant with legal requirements. An upside to this lever is that it generates a positive profit impact for a limited effort and at low risk, a downside is that it is not focused on capturing synergies with the remaining products in the portfolio and therefore insufficient on its own to break the organic growth comfort zone.

Extend product features: A second lever is to modify and improve the existing tech products offered to the currently targeted markets. This feature extension will likely, at an incremental level, improve sales (current and new biz), and strengthen customer retention. Feature extension requires some adjustments to the product architecture, but the technology platform the product is built on will remain the same, e.g., frontend & backend programming, database setup.

Consolidate products: Reducing the number of products providing similar features and functionalities is an essential lever to address structural challenges in the product portfolio and to manage complexity. Consolidating products does not necessarily mean having just one all-encompassing product, but the target is to have only one product per functionality area. The upside of utilising this lever is multifaceted since it helps the company prioritise its future development spending, it reduces O&M cost, it makes it easier for the sales organisation to promote the right products and it will likely also improve the customer satisfaction since more focus is dedicated to maintaining and improving fewer products.

Upgrade technology: Partially or fully re-platforming the product architecture and/or utilised IT operations hosting model to future proof the product cashflows is a powerful lever that requires significant effort. Benefits achieved from converting tech platform includes easier access to knowledge resources, improved delivery capabilities, and lower development and O&M cost just to mention a few. By simplifying the tech landscape, the company will be able to prioritise its IT spend and through that accelerate its ability to deliver value to the customers.

These levers can be used independently. However, the higher echelons of value creation lie in combining the levers in a value maximising sequence and through that design an optimal "journey" for the products. Product and portfolio owners need to be brave and move beyond the comfort zone of organic growth levers if they want to stay ahead of the game. They need to address the structural and technology challenges they are faced with and plot a course for their products’ journeys. Only then will they be able to break the boundaries of the organic growth zone and fully optimise their business.

About the authors: This article was written by a team of consultants from Oleto Associates, a strategy consulting firm based in Denmark. For more information please visit www.oleto.com

July 2024