The intriguing smart home market deals with everything from home appliances, IoT connected devices, artificial intelligence, energy optimisation and cities interlinked in eco-systems. The smart home market is expected to grow significantly. In 2018 the global market size was estimated to USD 30-60 billion according to various research groups and a forecasted annual growth rates of 12-14% towards 2023. The main part of this growth will take part in the Western world, dominated by the United States, and driven by the increasing consumer demand for convenience, design and sustainability.

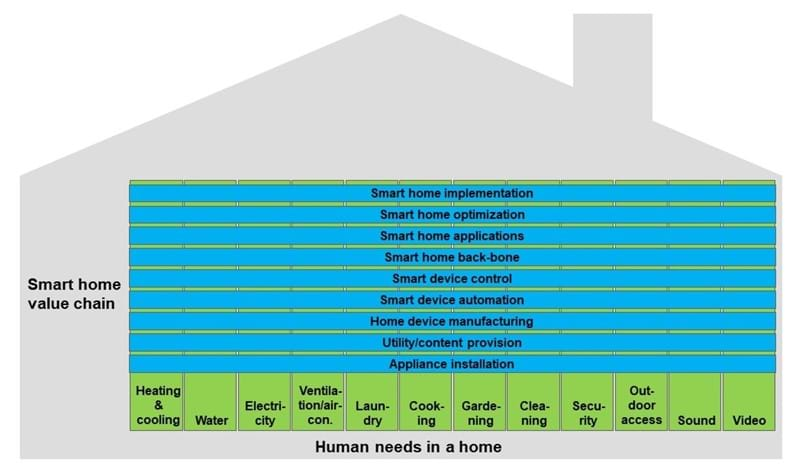

Exhibit 1: The overall Smart Home market segmentation. Source: Interviews; Misc. research; Oleto Associates

Many different players are moving to satisfy this demand. The global tech companies (Apple, Amazon, Google, and Microsoft) have put massive focus on AI and voice recognition which has turned intelligent assistants like Alexa and Siri from gadgets into viable control centres. Furthermore, many of the companies active in the smart home market today are building on top of their already existing technologies to offer smart devices. In addition you have the home appliance and consumer electronics industries contributing to the game. This gives a strong growth foundation for the industry which is increasingly crying out for common standards to increase ease of integration.

A Fragmented Market in Different Stages of Maturity

Oleto Associates has talked to several players in the industry and developed a tailored framework to reflect the different views on the market, see exhibit 1 and 2. In essence, we have segmented the market around human needs and the value chain to satisfy these needs.

By human needs we mean typical infrastructural service requirements in a home, e.g., heating, water, cleaning, entertainment etc. These needs are met through devices like thermostats, pipes, washing machines, etc. By the "smart home value chain", we mean the main products and services essential to meet the consumer needs. This spans from the production and distribution of basic resources like water and electricity, to the optimisation of a several inter-linked smart homes.

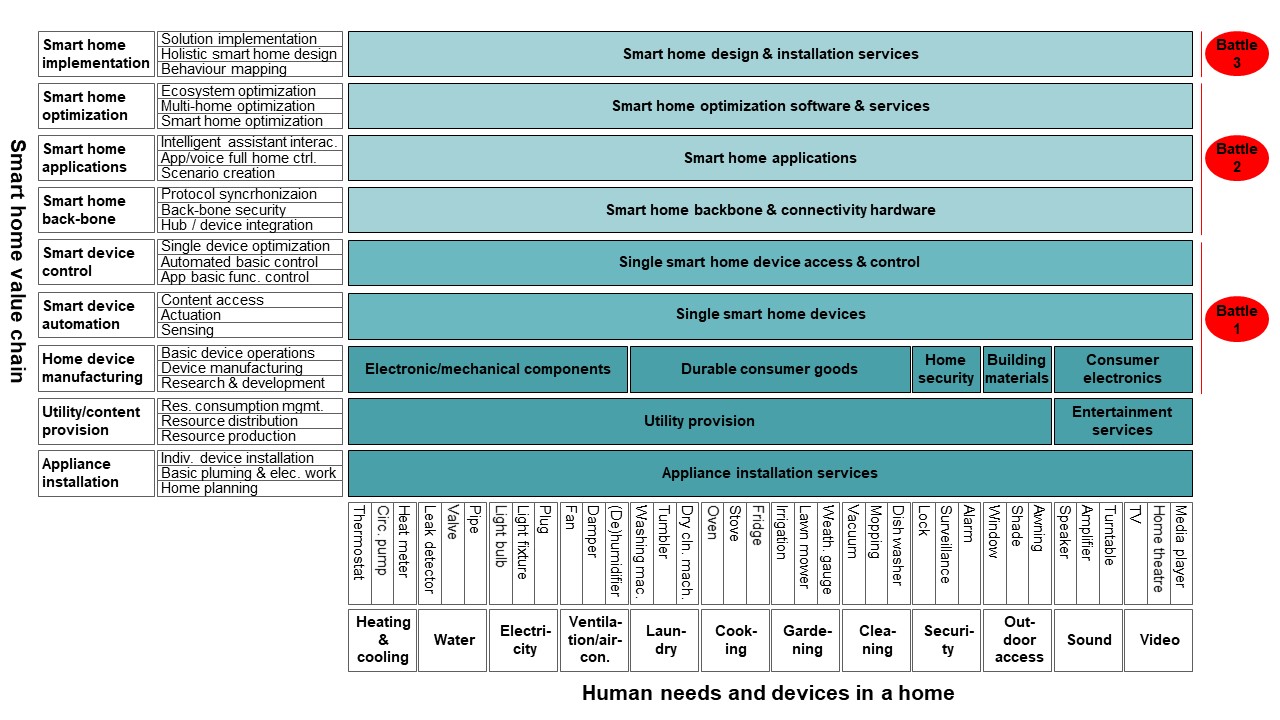

Exhibit 2: The detailed Smart Home market segmentation. Source: Interviews; Misc. research; Oleto Associates

Here is a description of the 14 segments in the smart home market:

- Appliance installation services: Installation of regular utility and appliances typically performed by electricians and plumbers in the consumers' local community. A market segment which has existed for a very long time.

- Utility provision: Producers of water and electricity, e.g., energy providers, utility companies. Naturally, highly mature markets, but subject to the green energy transformation.

- Entertainment services: Companies which create/distribute music, films and TV-shows, e.g., Netflix, Spotify, Disney, TV broadcasters. A well-established market although structural changes are seen.

- Electronic/mechanical components: Manufacturers of components that fit into a house, e.g., pumps, thermostats, and include companies like Danfoss or GE Industrial Solutions. Also a traditional market undergoing change.

- Durable consumer goods: Products like laundry machines, fridges, and garden irrigation system produced by firms like Electrolux, Westinghouse and LG. A mature market.

- Home security: Products and services made for securing private homes with players such as ADT Corp., Visonic, Frontpoint.

- Building materials and fixtures: Companies that make and sell shades, awnings and windows. In many cases this is carried out by local household goods and hardware stores. Also a mature market.

- Consumer electronics: Regular electronics like phones, TVs, stereos and speakers made by companies like Samsung, JBL and B&O. A traditional market segment undergoing change.

- Single smart home devices: Devices similar in functionality to the regular products we have described so far, and might be produced by the same companies, but differ in way that they also offer smart functionality like the ability to connect to a WiFi-network. A very dynamic market at the moment.

- Single smart home access & control: Access to and control of smart devices. Most players present in the smart home device segment will also be present in this segment via a mobile apps like the ones Sonos, Pioneer and Miele provide.

- Smart home backbone & connectivity hardware: In many smart homes there will be a backbone which ties all the different devices together. In some cases, this will be carried out by a physical unit that sits in the consumer's control cabinet. Examples are ABB’s KNX i-bus system, Wink Hub 2, Nexa Bridge, Control4, Homey. Connectivity concerns itself with how the devices are connected, i.e., which software protocols or standards are used in the home. KNX, ZigBee, Z-Wave or simple WiFi are examples of home automation protocols that allow devices to work together and be in the same overall system.

- Smart home applications: The next layer in managing smart homes encompasses applications that allow the consumer to see and control the home and all its devices. Google Home, ControlTouch, Nexa Bridge and Homey are examples. The application will often require that a backbone is in place and that all devices run on compatible protocols, depending on the protocols and devices used in the smart home. Players here produce solutions that deal with managing entire homes of smart devices for which reason it is important to be able to integrated with subcomponents.

- Smart home optimisation software & services: This segment has yet to develop. It consists of the software and service providers that gather, analyse and leverage data from one or more smart homes to create more personally tailored, economic and environmentally friendly smart homes. Energy optimisation plays a big role in this but it could also be other forms of optimisations, around security, maintenance, waste management, etc.

- Smart home design & installation services: Players in this segment provide the service of designing and implementing smart home solutions. Much like architects or interior designers do in regular homes.

Overall, the market is a scattered and unsettled and has yet to fully deliver on its full promise of a smart home in a seamless integrated way.

What is clear from exhibit 2 is that the bottom segments tends to be more mature. These are traditional markets with big players like Philips, Samsung and Electrolux. As we move up the value chain and devices become more automated and intelligently integrated, the level of maturity starts to drop. Smart home devices, including the access and control of them, are under way (think Nest, TP-Link, Philips Hue), but the smart home design and optimisation market is almost non-existent.

A clear symptom of low maturity in the upper segments in exhibit 2, is that smart homes are not yet for everybody due to high entry barriers. The technology is not intuitive and complete solutions are not readily available. If you want a smart home, it must either be thought into the architectural process from the beginning, or you have to spend significant amounts of time acquiring the knowledge necessary to setup the smart home. Other symptoms are the lack of experts in the field that could help you design and create a smart home, and the fact that not all devices work well together which restricts the consumer.

Three Intensifying Battles in the Smart Home Market

We expect at least 3 battles to take place in the next period, also see exhibit 2.

Battle 1 - The battle for the single smart home components:

This is the competition between the providers of traditional physical components/appliances and the tech providers allowing access to control these. We think we will see movements both ways, i.e., a component provider winning over a tech provider, like a traditional thermostat manufacturer producing smart thermostats as well as a global tech company entering the market for thermostats. For example Google has moved into hardware through its acquisition of Nest, a manufacturer of thermostats, cameras, doorbells and alarms. AT&T, a telecom giant, has made moves into the home security market with what it calls Digital Life – a combination of an app, cameras and sensors. And yet another, TP-Link, who started out making network devices like routers has moved into the electronic components markets with its connected plugs and light bulbs. We can think of this as players from the top segments moving down the value chain, and players from the bottom moving up. For instance, Google would traditionally be in the smart home applications segment with its Google Home app and intelligent assistant. Now they are starting to move down into segments that have traditionally belonged to a company like Danfoss, a Danish producer of thermostats. This move is justified because it allows Google to deliver a larger part of the end-product – a smart home.

Battle 2 - Smart home integration:

This battle is already a heated one. As both proprietary and open protocols seem to be available, this market is not only a fight for standard communication protocols but also who can provide the best hub, to integrated, manage and optimise it all. For example, Apple and Microsoft are taking on Amazon’s smart speaker and assistant, Echo and Alexa. Apple will sell its HomePod smart speaker which allows interactions with Siri, and Microsoft has partnered with Harman Kardon to introduce the Invoke which is linked to Cortana. A smart home is not really smart until all parts of the house are covered, and everything is connected. This suggests that a company can gain a larger market share by providing a larger part of the smart home.

Battle 3 - Smart home design & installation:

While this market has existed for many years in the high-end of the spectrum in the US, it is still very immature in, e.g., Europe. Who do you call when you want a complete smart home installation? This provides significant opportunities for players wanting to enter this market. Will the market be captured by electricians, engineering companies, banks or event new service companies?

What Should the Players Do?

With these competitive forces at play, the question for companies hoping to succeed in the smart home market, is "What viable strategies are available to us?".

By now it should be clear that continuing to manufacture devices without making them smart is likely not a feasible strategy in the long run. If the choice is between a thermostat that can be controlled via the consumer’s phone and a thermostat that cannot, assuming the price difference is small, most consumers will go for the mobile accessible thermostat due to convenience.

We believe the winning players in the smart home markets are the ones who choose between three strategies: A) Niche, B) Integration platform or C) Full smart home solution.

Strategy A): The niche strategy is well-known, we have already seen it in the market. Players specialise in manufacturing smart devices that are needed in the smart home. Philips and their smart lighting, Hue, is an example of this strategy. Lighting is essential in any home, and being good at producing smart lighting that connects and integrates well with various platforms and control software makes Philips a vital player in the smart home market. The niche player will not go into home automation protocols, AI, control platforms etc. but stay focused instead on specific hardware.

Strategy B): The second strategy, "integration platform", is about creating the hardware and software at the centre of all the smart devices – hubs, control centres, apps. This strategy focuses on integrating and controlling the devices produced by the niche players. This requires building competences within home automation protocols like KNX, Z-Wave or ZigBee. Swedish-Swiss ABB, a conglomerate within robotics, power, and heavy electrical equipment, introduced their i-bus KNX system which allows for the integration and control of shades, light, motion sensors, HVAC, and safety. The platform strategy focuses on letting consumers pick the devices and then creating a holistic system out of those devices, but it is considered to be relatively "high end" and requiring experts to setup.

Strategy C): The third strategy, "Full smart home solution", is without doubt the most advanced and difficult to execute. Players following this strategy aim at delivering the smart devices as well as the solution that controls and integrates them to provide the consumer with a full smart home solution. As we concluded earlier, the top segments in the smart home market are also the least mature. For that reason, we fail to see players who fully follow a solution strategy. But Apple, in typical ecosystem style, seems to be warming up to do it. Their HomeKit app allows control of different devices including grouping in rooms and scenario management and their new HomePod speaker brings Siri into the mix. The actual smart devices (cameras, bulbs, thermostats) are made by someone else but available on Apple’s website thus enabling them to deliver a partially full smart home solution by collecting the devices needed in one spot and offering the means to connect and control them.

Smart homes are not yet a commodity and the tipping point, for when it becomes one, seems distant. But with the war for smart homes solutions intensifying, and big players from many traditional industries lining up, it will be exciting to see which partnerships and acquisitions unfold as the players race towards delivering smart homes that are truly convenient, well-designed and sustainable.

About the authors: This article was written by a team of consultants from Oleto Associates, a strategy consulting firm based in Denmark. For more information please visit www.oleto.com.

July 2024